Forex trading has received a great deal of attention from those seeking quick, instant wealth. Nevertheless, without creating a strong and unique strategy to approach Forex, these individuals will be left penniless. Forex trading strategies lower potential risk in either day/swing trading for those individuals with solid determined traders who remain calm at crucial moments and stick to the strategy.

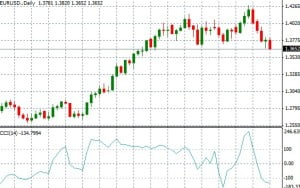

The challenge for many new forex traders is to identify the overall trend on the intraday charts. The 200 Exponential Moving Average (EMA) can solve the problem for them. 200 EMA is one of the most popular technical analysis indicators amongst forex traders.

The challenge for many new forex traders is to identify the overall trend on the intraday charts. The 200 Exponential Moving Average (EMA) can solve the problem for them. 200 EMA is one of the most popular technical analysis indicators amongst forex traders.

Risk to award ratio is often used when evaluating the risk of a Forex trading strategy, be it manual or automated. It’s one simple number that can tell a lot about a strategy. In fact, this number alone can tell a good strategy from a bad one. So what is the Risk to Award ratio and how do we use it?

Risk to award ratio is often used when evaluating the risk of a Forex trading strategy, be it manual or automated. It’s one simple number that can tell a lot about a strategy. In fact, this number alone can tell a good strategy from a bad one. So what is the Risk to Award ratio and how do we use it?