This is an entry for a Forex product called Pro Trade Copycat. The official site for this product is at protradecopycat.com. If you’re looking for more info about this product follow the link.

ForexCity Signal Services

This is an entry for a Forex product called ForexCity Signal Services. The official site for this product is at forexcitysignals.com. If you’re looking for more info about this product follow the link.

Fibonacci Strike

This is an entry for a Forex product called Fibonacci Strike. The official site for this product is at fibostrike.com. If you’re looking for more info about this product follow the link.

Forex Accurate

This is an entry for a Forex product called Forex Accurate. The official site for this product is at forexaccurate.com. If you’re looking for more info about this product follow the link.

Pips Cloner

The purpose of this page is to encourage and collect the user reviews of a Forex product called Pips Cloner. To get the details about this product (such as its features) or if you’re looking for support, please visit the official website that can be found at pipscloner.com.

Currency Correlations in Forex Trading

Everything in the currency market is interlinked to some extent. Most of the currency pairs show correlations. Knowing about these currency correlations is important for you in order for you to reduce risk and diversify your portfolio. This knowledge of currency correlations will help you diversify and double up your investment portfolio without having to invest in the same currency pair plus also reduce your exposure to the market.

Chinese Tiger Consumes Japanese Economic Status

China has consumed Japanese growth, stepping up to its rightful position on the throne of financial supremacy. Binary options can be used to trade on economic events and market direction. China’s increasing prevalence within the financial world, is elevating the impact of Chinese economic events.

Japan has surrendered the title of second biggest economy in the world to China.

Japanese success and forex allure to an extent became a self-fulfilling byproduct of its descent. The rising Yen, driven by investors seeking risk adverse FX pairs, fused with weakening consumer spending to contract Japanese fourth quarter economic results. The tiger’s prowl was in many ways already predetermined by the velocity of Chinese growth throughout 2010, tempering market surprise.

Forex Fisher Bot

This is an entry for a Forex product called Forex Fisher Bot. The official site for this product is at forexfisher.com. If you’re looking for more info about this product follow the link.

Bad Risk Management in Forex Trading

Bad risk management can create stress and ruin your forex trading career. You might have the best forex trading system in the world but it will fail if you don’t practice good risk management. Losses are inevitable with any forex system. But what if you have bad risk management? You will blow out your account soon and most probably don’t have enough money to make those profits that you had dreamed when you started trading forex.

Bad risk management is one of the main reason that fails the budding career of many new forex traders. Many people start trading forex dreaming of making a million in just a few months. They overtrade, take on too much risk and get blown out by the market.

Push Button Pips

This is an entry for a Forex product called Push Button Pips. The official site for this product is at pushbuttonpips.com. If you’re looking for more info about this product follow the link.

Keep A Trading Journal

Why you need to keep a trading journal? Trading is all about being disciplined. Successful traders don’t have any holy grail of systems or indicators. What they have is a lot of common sense and discipline. The importance of keeping a trading journal cannot be overemphasized if you want to become a successful trader. This is how hedge fund managers train their new traders. No doubt, leading banks are able to train and breed successful and pro traders using this simple strategy of inculcating the habit of keeping a trading journal and being disciplined in trading.

Importance of Timeframe Coordination in Forex Trading

Using the higher timeframe to confirm a trading signal on a lower timeframe is a skill that can be highly rewarding for a trader. Many traders take a trade that is coordinated on the lower timeframe but not the higher timeframe which often gives them bad trades and a waste of time and energy.

Suppose, you find the trend on the intraday chart and the trend on the daily chart in the same direction, it is like having the wind at your back.If you can master the art of identifying currency pairs that have the intraday trends in the same direction as the daily and the weekly trends, you can reap immense rewards.

Auto Pip Bot

This is an entry for a Forex product called Auto Pip Bot. The official site for this product is at autopipbot.com. If you’re looking for more info about this product follow the link.

Forex Fortune Signal

This is an entry for a Forex product called Forex Fortune Signal. The official site for this product is at forexfortunesignal.com. If you’re looking for more info about this product follow the link.

Breakout Trading Entry, Exit and Stop Loss Strategies

Breakout trading can be highly profitable. But the problem is most breakouts tend to fail often. A breakout fails when the price returns to a point before the breakout. Suppose the price breaks out above the resistance line but soon retraces back below the resistance line. This means the breakout was false. But in many cases, prices retraces itself slightly above or below an important breakout level before continuing in the direction of the breakout.

Elemental Trader

This is an entry for a Forex product called Elemental Trader. The official site for this product is at elementaltrader.com. If you’re looking for more info about this product follow the link.

Divergence Trading With MACD Histogram

Divergences are considered to be pretty strong trend reversal signals. Divergence happens when the price action and the indicator in this case the histogram moves in the opposite directions. For example, the price action makes a new high while the indicator makes a new low or the price action makes a new low while the indicator makes a new high.

When divergence between the price action and the indicator develops, it means a potential trend reversal in the market. MACD is a very versatile technical indicator that can be used to trade these divergence patterns.

How To Trade With The MACD Histogram

A MACD Histogram is a bar chart. The slope of the MACD Histogram is very important. This is the best indicator that tells whether bears or bulls are controlling the market. An upward slopping histogram indicates that the bulls are getting stronger while a downward sloping histogram indicates that the bears are getting stronger.

The price trend whether up or down is likely to continue if it is in the same direction as the slope of the MACD Histogram. When the slope of the histogram and the price action are moving in opposite direction, it means that the trend is in jeopardy. As a rule, always try to trade in the direction of the slope of the histogram.

How To Avoid Forex Scams

The Forex market is an unpredictable scene and anyone determined to guarantee any outcome is probably a scammer. Because this market is practically unregulated, those looking to profit from inexperienced traders are doing so via online means. Its a shady enterprise, but it appears as legitimate.

The rule of thumb is, if it’s too good to be true, then it’s just that… be cautious, these promises about making money while you’re asleep or making quick money without any effort is just a load of crap. Wealthy people don’t get to their wealth without doing anything, without making any sacrifices. When approached by an unbelievable offer, don’t get screwed. Here’s what you need to look for.

Trader Swiper

This is an entry for a Forex product called Trader Swiper. The official site for this product is at traderswiper.com. If you’re looking for more info about this product follow the link.

Forex Solomon

This is an entry for a Forex product called Forex Solomon. The official site for this product is at forexsolomon.com. If you’re looking for more info about this product follow the link.

Rover North Forex System

This is an entry for a Forex product called Rover North Forex System. The official site for this product is at rovernorthforexsystem.com. If you’re looking for more info about this product follow the link.

Honest Forex Signals

This is an entry for a Forex product called Honest Forex Signals. The official site for this product is at honestforexsignals.com. If you’re looking for more info about this product follow the link.

How to Be a Top Forex Trader

In the Forex market, everyone wants to become the infamous powerhouse broker with an unending stream of money coming out of their pockets. The reality is, according to Forex brokers, 90% of traders fail terribly because they just do not know what they are doing, how things work, or that they aren’t prepared enough. The other 10 percent, well, consider that only 5% comes even while the other 5% experiences repeated success. How do they do it? In this post, I’ll explain five key principles required to become a power trader:

Forex Trading Pro System

This is an entry for a Forex product called Forex Trading Pro System. The official site for this product is at fxtradingprosystem.com. If you’re looking for more info about this product follow the link.

Forex Megabot

This is an entry for a Forex product called Forex Megabot. The official site for this product is at forexmegabot.org. If you’re looking for more info about this product follow the link.

Fibonacci and Online FX Trading

Fibonacci and Online FX Trading offers the capacity not only to react promptly to market change but to react using an online platform which has the necessary strategic resources. The Fibonacci pattern is a well regarded mathematical sequence and can be applied to the forex way of thinking.

The foreign exchange market, aptly known as forex is the biggest financial market in the world and as a result the sheer level of variables, opens a vast array of possibility regarding technical analysis and trading patterns.

Safe Trade Pro

This is an entry for a Forex product called Safe Trade Pro. The official site for this product is at safetradepro.com. If you’re looking for more info about this product follow the link.

How Can a Computer Program Help Make Forex Trading Decisions

Forex trading is a fast paced, complex, high risk, high reward activity. Good split second decision making can be the difference between riches or ruin on the forex markets. That’s why so many forex traders use computer programs to make forex trading decisions. Many forex traders make consistent profits using computer programs designed to help make forex trading decisions. Don’t quite understand how a forex trading computer program can make decisions for you? Read on.

Forex Godfather

This is an entry for a Forex product called Forex Godfather. The official site for this product is at forexgodfather.com. If you’re looking for more info about this product follow the link.

Trend Trading With Bollinger Bands

Do you know this fact that the Bollinger Bands can be used as a very effective tool for detecting and trading trends even though most of us have only be taught to use them in a range bound market. Here is how to capture the trend with Bollinger Bands (BBs). Bollinger bands are used to measure the deviation or what we call volatility in the market. Bollinger bands measure the standard deviation of price action away from its 20 period moving average.

Deciding on a Lot for Your Forex Trading

As a Forex trader, your natural desire is to reduce risks as much as possible. Inevitably, you develop risk management strategies to combat the side-effects of risky trades. In doing so, Forex traders must pay close attention to the size of their lots. Forex strategists assert that the smaller the lot size is, the better, consequently boosting flexibility and overall risk management. So what are the types of Forex slots? Forex slots come in three forms: 1) Micro Lots, 2) Mini Lots and 3) Standard Lots.

A Daily Timeframe Strategy That Pulls 100-500+ Pips Per Trade

This is a daily timeframe strategy that can make hundreds of pips per trade for you without you having to spend hours staring at your computer monitor. Wake up in the morning, scan the charts on the daily timeframe, setup your trade and that’s it. After that you are free to do whatever you want to do.

Let’s discuss this Daily Timeframe Strategy. This Daily Timeframe strategy uses only two indicators. These are the Bill William’s Accelerator Oscillator (AC) and the Stochastic Oscillator. The Bill William’s Acceleration/Deceleration Indicator (AC) measures the acceleration and deceleration of the current driving force.

Perfect Order Forex Strategy

Perfect order takes places when the moving averages are stacked in a sequential order. For example, suppose you are using a three simple moving average system, 10 day SMA, 20 day SMA and 50 day SMA. In an uptrend, a perfect order world be when the 10 day SMA is above the 20 day SMA and the 20 day SMA is above the 50 day SMA. In the same manner, the 100 day SMA should be below the 50 day SMA and the 200 day SMA should be below the 100 day SMA.

What is Forex Trading?

A basic definition of Forex Trading can be unraveled relatively easily however utilizing this definition to your maximum advantage requires broader foundations. The roots of Forex Trading are derived from and are an abbreviation for, the Foreign Exchange market. The foreign exchange market is a constant hubbub of activity both for the financial and domestic world.

The forex market need not involve substantial financial knowledge; in fact you have probably already taken part in the forex community as the result of a simple trip to your local bank to convert that leftover change from your trip overseas.

Copy Paste Pips

This is an entry for a Forex product called Copy Paste Pips. The official site for this product is at copypastepips.com. If you’re looking for more info about this product follow the link.

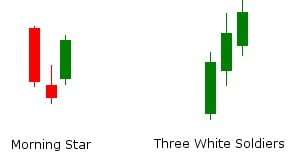

The Morning Star And The Three White Soldiers Candlestick Patterns

Three stick candlestick patterns are more complicated than the single stick and two stick patterns. These patterns take three days to emerge as a valid signal. One such three stick candlestick trend reversal pattern is the Morning Star. However, a Morning Star and the Bullish Doji Star look almost the same but are in fact two different three stick candlestick patterns. You need to know how to distinguish between them.

In case of the Morning Star and the Bullish Doji Star Patterns, the first day is a large bearish candle, the second day in case of the Doji Star Pattern is a True Doji while in case of the Morning Star it is almost a Doji. The price action behind these two patterns is almost the same.

Leveraged Carry Trading Strategy

Carry trade strategy entails buying a high interest rate currency and selling a low interest rate currency. Suppose, New Zealand Dollar NZD offers an interest rate of 4.35% while the Japanese Yen JPY offers 0.35%. Carry trade strategy involves buying NZD and selling JPY. The investor earns a profit equal to the interest rate differential of 4% as long as the exchange rate between the two currencies does not change.

Carry trade is one of the fundamental trading strategies that uses the basic economic principle that money constantly keeps on flowing from a low interest market to a high interest market. Markets that offer the highest interest rate attract the most capital. Countries are no different. Countries offering a better interest rate attract more capital as compared to countries offering low interest rate.

The Truth Behind Trading Forex Online

Forex trading online can be a very exciting and lucrative hobby. However, you need to know what you are doing to limit the amount of money you could lose. Here are some of the basic things you should know before you even attempt to trade online.

Are you interested in taking part in Forex trading online? If so then you may find that it can be slightly confusing. Many companies let you open a trading account with just $250. However, while this may seem like a very small amount, you need to think that it could let you control more than $25,000.

Forex Steam

This is an entry for a Forex product called Forex Steam. The official site for this product is at forexsteam.com. If you’re looking for more info about this product follow the link.

Trading Retracements With Fibonacci Levels

In the last article, we discussed how to trade breakouts with Fib Projection Levels. Let’s discuss that breakout situation again. But this time, let’s assume it fails. Again assume that breakout scenario where EURUSD price rise from 1.2200 to 1.2300. But you are less confident that the price action will continue to rise. You still want to take the trade with one standard lot (100,000 units).

You enter the market with 1/4 lot (25,000 units) at 1.2300 just like before. If the prices continue to rise just like before, you can still profit from that move by gradually adding to the partial position to target the exit of 1.2400. Now, suppose the price doesn’t rise.

Advantages of a Forex Robot

When we think of a Forex robot, we’re hoping that another Wall-E could make our Forex decisions for us, but that’s no the case. There are all sorts and varieties of Forex software that use automation (i.e. a robot) to create several charts and diagrams to analyze our stocks. We, nonetheless, need to make a choice on what software is the best for us and so, this post will explain what to look for in a Forex robot software.

Forex Raider

This is an entry for a Forex product called Forex Raider. The official site for this product is at fxraider.com. If you’re looking for more info about this product follow the link.

Trading Breakouts With Fibonacci Projection Levels

Most breakouts tend to fail. It is impossible to know which breakout will succeed and which breakout will fail. But you have to be in it to win it. As a trend trader, you have to take every trade. However, using Fibonacci can optimize your few wins and minimize many losses.

When you spot the breakout candle, enter the market with half of your trade size. If the price continues in your favor as you had anticipated add 1/4th of the trade size at 138.2% of the initial move. And if the momentum continues in the direction that you had wanted and anticipated, add the final 1/4th of the trade size at 162.8% of the move.

Analysis of the Five Types of Forex Brokers

There are variable kinds of Brokers, but in total, there exists five types. These five types of Forex brokers have access to brokerage firms that are recognized and considered legitimate versus those shady backdoor brokers who cannot provide you any guarantees. If you want to succeed in getting the right broker, I suggest reviewing their policies. They have similar access to the Forex market, but their terms and conditions might make you choose one type of broker over another.

Pros and Cons of Forex News Trading Strategies

The Forex market has always been rapidly growing, especially thanks to the affordability and accessibility of internet access and the growing investment opportunities provided by Forex. Whilst it’s accessibilities are advantageous, it’s obvious there are significant investment hurdles such as market fluctuations, leverage, and other investment strategies–it is also one of the most unstable. In other posts, I’ve explained how Forex traders use two forms of analysis: fundamental and technical; however, I did not go through very thoroughly the advantages of news release analysis and how they can effect Forex trading.

Trading Support And Resistance Using Turnabouts Strategy

When you make a mistake in trading, there are no money back guarantees that can give you back your hard earned money. Turnabout is a conservative approach to trading support and resistance. This is the closest to the money back guarantee that you can get when trading support and resistance.

Support and resistance is one of the key concepts in trading. Support is like the floor of a room. When you hit it with a ball, the ball will bounce up. In the same manner, resistance is like the ceiling of a room. When you hit it with a ball, the ball will bounce down.

Guide To Getting Rich With Forex Robots

This is an entry for a Forex product called Guide To Getting Rich With Forex Robots. The official site for this product is at guidetogettingrichwithforexrobots.com. If you’re looking for more info about this product follow the link.

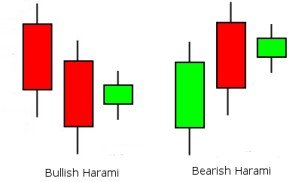

Harami – An Important Trend Reversal Candlestick Pattern

Harami is an important trend reversal pattern. It is a two day candlestick pattern with the candle of the setup day longer than the candle of the signal day. Harami is the Japanese word for pregnant. If you draw this a pattern, it will look like a pregnant woman. The pattern can be bullish as well as bearish.

In case of the bullish harami, the first day is a bearish candle that occurs in a downtrend. On the second day, bulls enter the market and start moving the prices higher but not with much success as the price close lower than the open of the first day and the first day’s high is not surpassed. However, when this pattern appears it culminates in a trend reversal.

Choosing the Right Forex Software

Software usage is an essential part of successful Forex trading. Softwares allow complete automation, organization, and prioritization of stocks, follow trends, calculate probabilities and assign characteristics that may benefit your day trading skills. Knowing which software to choose can be vital to your Forex day trading success. Software react almost instantaneously to trends, allowing you to optimize your time and not worry about the hardship of statistical analysis. Furthermore, even if you’re new, you can still make use of software since a great aspect of them is user-friendliness and teaching. Some software even come with educational material to not only understand the way the software graphs trends, but how to read them and how to take advantage of such information. In order to find the right software, follow this advice:

ETF Trend Trading

This is an entry for a Forex product called ETF Trend Trading. The official site for this product is at etftradingcourse.com. If you’re looking for more info about this product follow the link.

Signals Machine

This is an entry for a Forex product called Signals Machine. The official site for this product is at signalsmachine.com. If you’re looking for more info about this product follow the link.

Tom Strignano Money Management

This is an entry for a Forex product called Tom Strignano Money Management. The official site for this product is at tomstrignanomoneymanagement.com. If you’re looking for more info about this product follow the link.

How To Choose The Right Forex Broker

Before you jump into Forex trading, consider what the environment you’re getting into. Forex is considered a risky investment, so approach with caution. As we all know, every investment won’t return the profit we sought, and similarly, every potential investor may not have what it takes to be a Forex trader. If you’re approaching these feelings of uncertainty, I recommend speaking with a Forex broker.

Forex Growth Bot

This is an entry for a Forex product called Forex Growth Bot. The official site for this product is at forexgrowthbot.com. If you’re looking for more info about this product follow the link.

A Successful Start to Forex Trading

In order to start a home business, one must fully analyze their current financial wit and their capabilities. Investment must come with a strong emotional security because it’s important for you to fully understand that your investments come at a high price, there’s always the risk of total failure. Nevertheless, you mustn’t gamble your money away, you’ve got to be prepared, diligent, smart, and very determined.